Personal Loans Ontario: Personalized Financial Prepare For Your Requirements

Personal Loans Ontario: Personalized Financial Prepare For Your Requirements

Blog Article

Navigate Your Financial Trip With Reliable Funding Providers Designed for Your Success

Dependable loan solutions customized to satisfy your specific demands can play a critical duty in this process, using an organized method to securing the necessary funds for your ambitions. By comprehending the details of various finance alternatives, making informed choices throughout the application process, and efficiently managing repayments, people can take advantage of financings as tactical devices for reaching their economic landmarks.

Understanding Your Financial Needs

Understanding your financial needs is essential for making educated choices and accomplishing economic security. By taking the time to assess your financial circumstance, you can identify your lasting and temporary goals, produce a budget, and create a strategy to get to financial success.

Furthermore, understanding your economic requirements entails acknowledging the difference between important expenses and discretionary spending. Prioritizing your requirements over wants can assist you manage your financial resources extra efficiently and prevent unnecessary debt. Additionally, think about variables such as emergency funds, retired life preparation, insurance coverage, and future monetary goals when assessing your economic needs.

Exploring Funding Choices

When considering your monetary demands, it is important to check out numerous financing alternatives offered to establish the most appropriate option for your details circumstances. Understanding the different sorts of car loans can help you make educated decisions that align with your monetary goals.

One usual kind is an individual funding, which is unsecured and can be used for various functions such as financial obligation consolidation, home renovations, or unforeseen expenses. Personal financings normally have actually fixed rate of interest and month-to-month repayments, making it easier to budget plan.

An additional alternative is a protected financing, where you offer collateral such as an automobile or property. Protected loans usually feature reduced rate of interest due to the reduced threat for the lending institution.

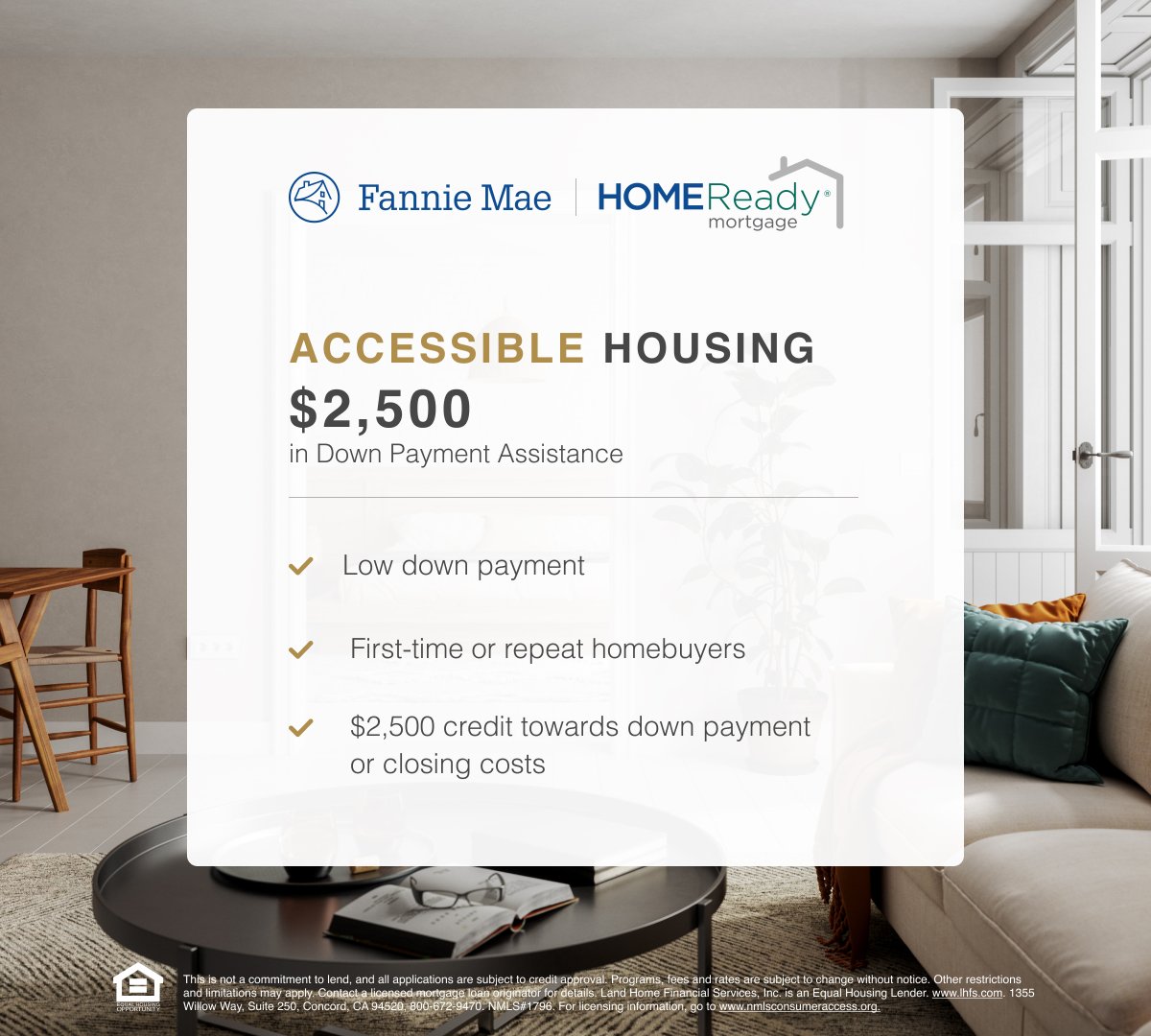

For those wanting to acquire a home, a mortgage funding is a popular selection. Home mortgages can differ in terms, rate of interest, and down settlement demands, so it's vital to discover different lending institutions to discover the ideal fit for your circumstance.

Applying for the Right Finance

Browsing the procedure of using for a loan necessitates an extensive analysis of your monetary needs and diligent research study into the available alternatives. Begin by examining the purpose of the finance-- whether it is for a major acquisition, financial debt combination, emergencies, or various other requirements.

Once you've determined your economic demands, it's time to discover the financing products offered by numerous lending institutions. Compare passion rates, repayment terms, fees, and qualification standards to find the car loan that best matches your requirements. Furthermore, consider elements such as the loan provider's online reputation, client service top quality, and online devices for handling your finance.

When using for a lending, make certain that you offer full and accurate details to accelerate over here the authorization procedure. Be prepared to submit documents such as proof of revenue, recognition, and economic statements as called for. By very carefully choosing the ideal lending and completing the application faithfully, you can establish yourself up for financial success.

Managing Financing Repayments

Efficient monitoring of loan payments is necessary for maintaining monetary stability and meeting your obligations responsibly. By clearly determining exactly how much you can designate towards loan repayments each month, you can make certain timely repayments and prevent any type of monetary strain.

Several economic establishments supply options such as finance forbearance, deferment, or restructuring to assist consumers encountering economic challenges. By proactively managing your finance payments, you can preserve economic health and wellness and work towards achieving your long-lasting economic objectives.

Leveraging Lendings for Economic Success

Leveraging finances tactically can be a powerful device in attaining economic success and reaching your long-lasting objectives. When used wisely, finances can provide the necessary capital to buy chances that might generate high returns, such as starting a service, seeking greater education and learning, or buying realty. loan ontario. By leveraging financings, individuals can increase their wealth-building procedure, as long as they have a clear prepare for repayment check my reference and a complete understanding of the dangers entailed

One key facet of leveraging car loans for economic success is to meticulously assess the conditions of the funding. Understanding the rates of interest, repayment timetable, and any type of affiliated costs is vital to make sure that the financing straightens with your monetary goals. Furthermore, it's vital to obtain just what you require and can sensibly pay for to settle to avoid coming under a financial obligation trap.

Conclusion

By comprehending the ins and outs of various finance options, making educated decisions throughout the application process, and properly handling settlements, people can leverage lendings as tactical tools for reaching their economic milestones. personal address loans ontario. By proactively handling your loan payments, you can maintain financial wellness and job towards attaining your long-term economic goals

One trick facet of leveraging finances for monetary success is to thoroughly analyze the terms and problems of the car loan.In final thought, comprehending your economic needs, checking out finance options, applying for the best financing, managing funding payments, and leveraging finances for economic success are critical actions in navigating your economic trip. It is crucial to carefully think about all elements of loans and monetary choices to make sure long-lasting financial security and success.

Report this page